Singapore IRAS GST legislation: Tax Facts

Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported goods, as well as a wide-ranging category of goods and services in Singapore. GST is administered by IRAS and is more commonly known as the Value-Added Tax (VAT) in overseas developed countries such as Japan or…

Read morePOSTED BY

Tax Dept

Responsibilities and Skills of a Good Auditor

As per the Singapore Companies Act, only registered public accountants may audit financial reports of companies that do not meet the “small company” criteria for audit exemption. Auditors are expected to meet the demands of both internal and external forces when catering to clients. They must ensure these companies comply with the standards of financial…

Read morePOSTED BY

Dev Team

Top 3 Criteria for Hiring an Auditing Firm in Singapore

Hiring an audit firm is an important milestone for businesses and companies as an effort to guarantee the accuracy and transparency of their financial reports. By Singaporean legislation, companies that do not meet the audit exemption criteria must ensure their financial statements and accounting records are audited yearly. Most accounting firms in Singapore, regardless of…

Read morePOSTED BY

Paul Wan & Co

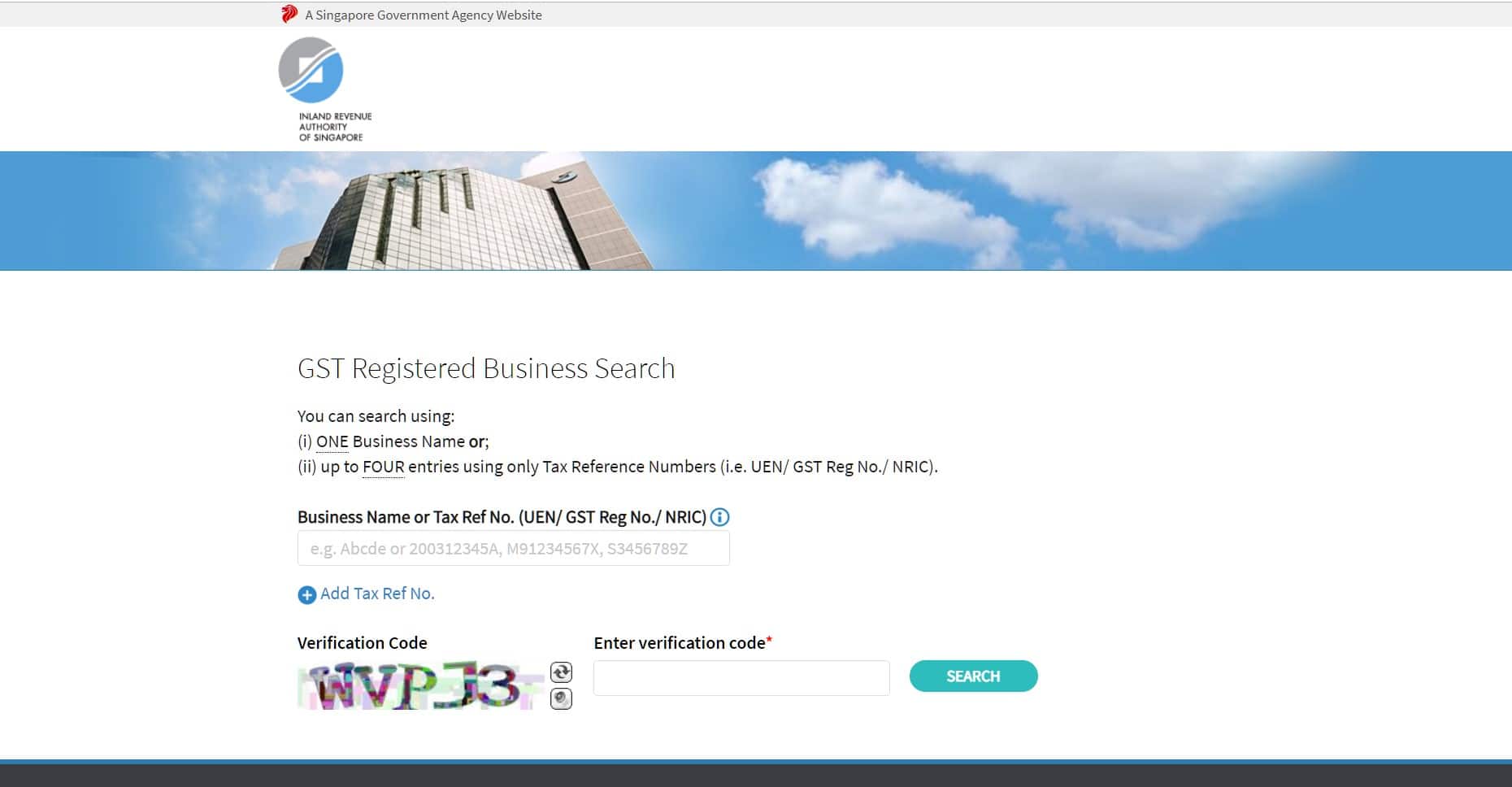

Singapore Tax Guide: Check a Company’s GST Registration Number

By Singaporean legislation, a GST registered company may claim back GST incurred on business expenses and file quarterly GST returns to the Inland Revenue Authority of Singapore (IRAS). Goods and Services Tax or GST is a broad-based consumption tax charged in addition to the price of imported products, as well as a wide-ranging category of…

Read morePOSTED BY

Tax Dept

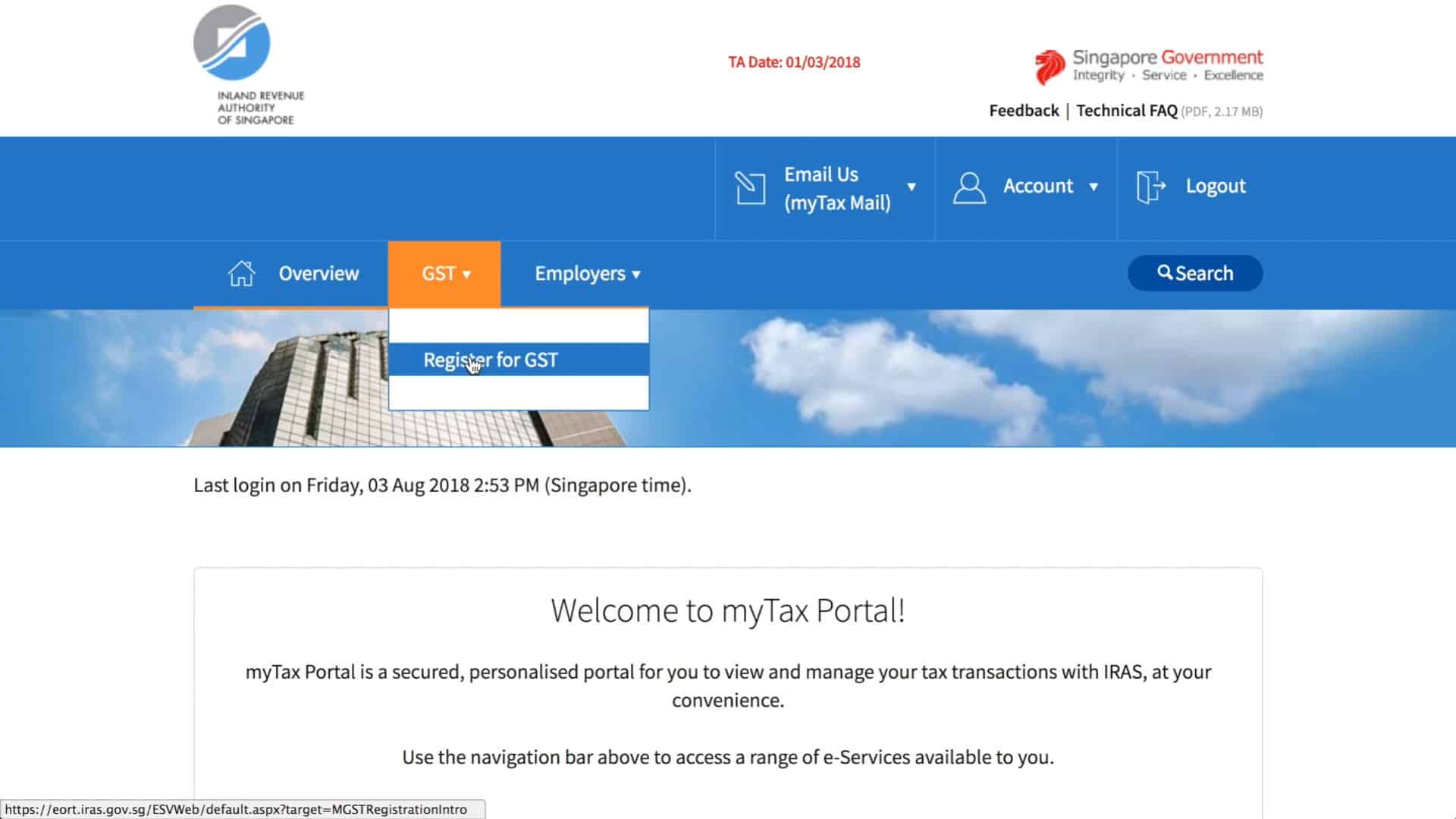

Singapore Tax Guide: Acquiring a GST Registration Number

As per Singaporean legislation, individuals and companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore (IRAS). Companies that apply for GST are given a GST registration number for identification purposes. GST registered companies may then file tax claims for business expenses as well as submit quarterly GST returns…

Read morePOSTED BY